Not long ago, hospitals suing patients for unpaid medical debt made healthcare headlines. A sampling of Kaiser Health News stories includes:

- Hundreds of Hospitals Sue Patients or Threaten Their Credit, a KHN Investigation Finds. Does Yours?

- Medical Bills Can Shatter Lives. North Carolina May Act to ‘De-Weaponize’ That Debt

- Upended: How Medical Debt Changed Their Lives

- A Healthcare Giant Sold Off Dozens of Hospitals – But Continued Suing Patients

- UVA Health Will Wipe Out Tens of Thousands of Lawsuits Against Patients

As someone who has worked in healthcare for 30+ years and has frequently interacted with the healthcare system as a patient, mother and caregiver, I know there is a better way for hospitals and health systems – a patient-centered revenue cycle process.

Why Hospitals Need to Adopt a Patient-Centered Revenue Cycle Process

Let me start with why I am advocating hospitals create a patient-centered revenue cycle process.

The Grey Tsunami

Each day, 10,000 Americans turn 65 and instantly become Medicare beneficiaries. Nearly 50 percent of all Medicare beneficiaries are enrolled in a Medicare Advantage plan and the Congressional Budget Office (CBO) expects this to climb to more than 60 percent by 2032.

The growing prevalence of Medicare Advantage means a whole new and substantial burden on the hospital contracting and revenue cycle teams. Whereas billing set-up and processing was relatively straightforward for traditional Medicare, every payer operates differently and requires a unique negotiation, billing system set-up, and revenue capture alignment. The level of complication is exponentially higher for the hospital teams – and the level of sophistication needed by the contracting and revenue cycle talent is much greater as well. It also means an extra level of prior authorizations, medical necessity reviews, chart reviews, supplemental documentation, coordination around in-and-out-of-network services, additional layers of utilization management for transitions of care, and different prescription formularies for each plan.

In short, the greying of America and the popularity of Medicare Advantage plans mean more work for hospital revenue cycle and clinical staff.

The Dominance of High-Deductible Health Plans

In 2021, more than 55 percent of all private sector workers were enrolled in a high deductible plan. That means, for 55 percent of all privately insured patients who come through the doors of a hospital, you will be chasing them to collect coinsurance and deductibles up to their out-of-pocket maximum.

In 2020, patient premium contributions and deductibles accounted for more than 11 percent of median income, up more than 20 percent in 10 years.

The Prevalence of Medical Debt

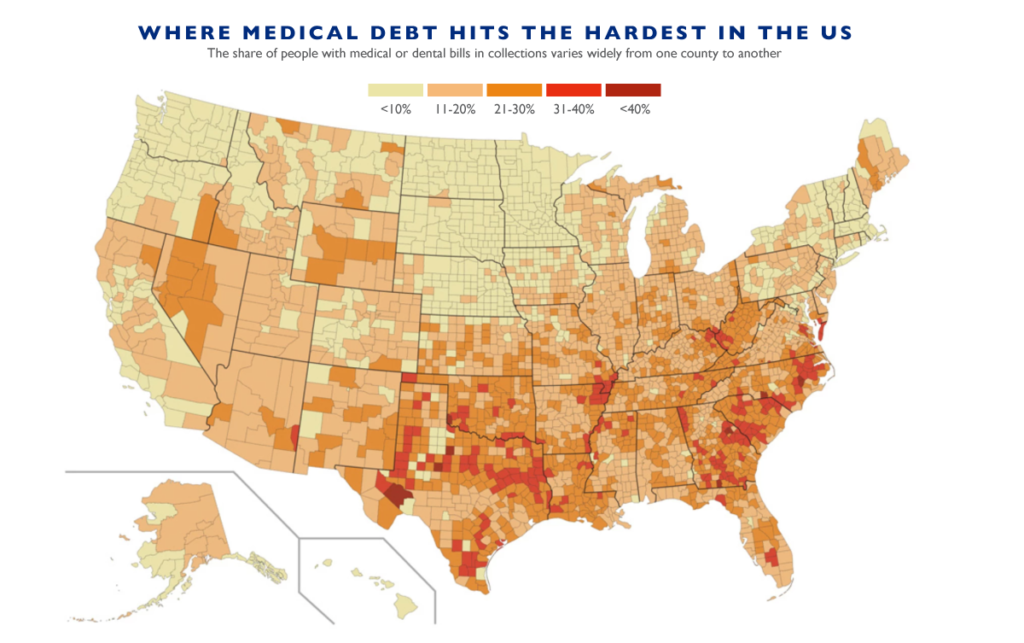

According to Kaiser Health News, 100 million people – that is, 41 percent of adults – have medical debt. Over the past five years, more than half of US adults incurred medical debt. One quarter of adults with healthcare debt owe more than $5,000 and one in five never expect to pay it off. And medical debt is nearly twice as common for those under 30 as those over 65.

U.S. counties with the highest share of residents with multiple chronic conditions, such as diabetes and heart disease, also tend to have the most medical debt. That makes illness a stronger predictor of medical debt than either poverty or insurance.

A patient-centric revenue cycle offers the opportunity to anticipate and mitigate the impact of medical indebtedness on patients and their families in the hospital’s community.

Hospitals Are Facing Consolidation and Market Pressures from Nontraditional Entrants

As I wrote in an earlier blog, there has been massive consolidation on the health delivery side over the past few years and it is slowly eroding services, revenue and margin from hospitals. At the same time, there has been a marked increase in competition from nontraditional entrants.

- Amazon’s acquisition of OneMedical in a $3.9B all-cash deal gives them a storefront, telehealth, subscription-based services, and a clinical platform. Before the Amazon acquisition, OneMedical acquired Iora Health, which was focused on Medicare patients and risk-based contracts. Now with Amazon funding, expansion is expected to continue.

- Walmart has been dipping its toe in the water for some time, working to refine the model with a number of initial targeted clinics and low-cost generics. Now that it has a strong operating model in place, it continues to expand, operating more than 32 health centers in Florida, Arkansas, Illinois, Georgia and Texas.

- The grocery chain Kroger runs more than 200 health clinics inside store locations that offer diagnostic treatment, ongoing health management, wellness visits, and preventive care.

- Dollar General operates 18,000 stores across 47 states. It has partnered with DocGo, a mobile primary and urgent care provider organization, targeting Medicare, Medicaid and the privately insured. With a focus on primary, chronic, preventive and urgent care, they also offer testing, EKGs, and labs, and as a result, can further erode ambulatory, urgent, emergent, laboratory, and imaging services within the hospital footprint.

- CVS not only continues to expand with services directly in stores, but with its $8B acquisition of Signify Health, it has expanded directly into home visits.

A Patient-Centric Revenue Cycle Approach

At its heart, a patient-centric revenue cycle approach focuses on the patient, anticipating and streamlining their experience. Patient-centered revenue cycle, when done properly, anticipates the patient long before they request care, and begins with the payer contracting and system billing set-up process, training staff, creating financial vehicles, education materials, patient-friendly bills design and more – and it adheres to shopping experience framework.

The key tenets are:

Map the Process End to End

Hospitals are advised to take the time to map the current state of the entire process, on an end-to-end basis, from contract to first contact through collection. Then, for each patient profile, map what this process should look like, so that it is as absolutely clear and streamlined as possible, providing opportunities for revenue capture earlier and with appropriate options such as friendly navigators offering financing choices.

Leverage Pre-Determinations

Oral surgeons do it all the time. They take the time to check what benefits will apply and what the patient liability will be to set expectations early, avoid negative surprises, and again, to offer payment vehicles on a pre-service basis.

Provide Financial Navigators

Adopt a financial navigator model – that is, someone to help shepherd patients through the confusing, bureaucratic and intimidating process. Satisfaction with the hospital will increase, as will collections.

Establish Payment and Financing Up-Front

Ensure your hospital has varying up-front payment and long-term financing options, including technology that simplifies this process for staff and patients.

Make Bills Understandable

Collections are adversely impacted when patients are confused as to why their insurance did or did not pay. Overly ambiguous messaging leads to long delays in payment as patients feel the burden of having to do their diligence and research by logging into portals, calling their insurance, contacting the hospital billing office, and more.

The hospital bill is a method of communication, a contact point, an opportunity to make the process easy or more difficult, and to secure repeat business or send the patient elsewhere the next time.

Patient-centered revenue cycle reorients the focus from being based on the needs and convenience of the hospital, to that of the patient. It draws from other industries that put the consumer first, minimizing abrasion, reducing confusion, and smoothing out the process – ultimately improving patient and staff satisfaction while driving hospital revenue growth.